How technology can shape the corporate world of the future: Episode 3 - RegTech in all its glory

What is RegTech?

RegTech isn’t new, but boy is it growing. RegTech is short for regulatory technology and it encompasses all applications of technology with the aim to enhance regulatory compliance for businesses. The regulatory rules that firms have to comply with are at a record high, with such rule changes having increased by 500% just in the last decade.

All regulations are in place to protect businesses, and failure to comply leaves a business open to fines, lawsuits and the betrayal of its customers’ trust. Financial regulations aim to protect a company from fraud; security regulations focus on protecting against data breaches; and safety regulations protect the workers, for example. As time goes on, the support for constantly updating regulations increases, and for a business, this is often quite a headache. Alas… RegTech!

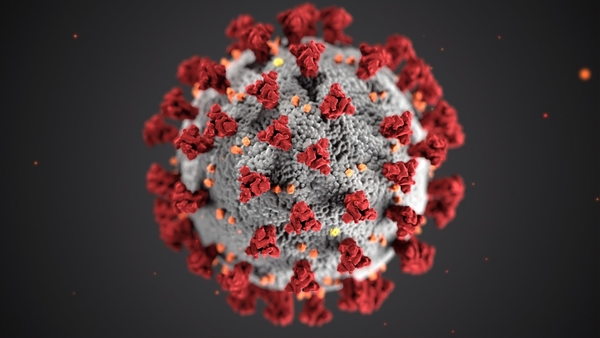

The influence of COVID-19 on RegTech

The COVID-19 crisis has led to businesses needing to be proactive in order to survive, ensuring quick adaptability to the current financial climate. During a crisis, a financial institution can be very exposed, and thus the need for RegTech becomes that much greater. With one of the main worries for a business being survival and post-COVID-19 continuity, solutions like ISO 22301 - Business Continuity Management System Standard (BCMS), allow for businesses to establish measures that protect them from the risks associated with discontinuities. These systems provide clear guidance on how to handle and recover from disruptions should they ever arise.

The European Banking Authority (EBA) released a statement which disclosed specific actions that would help reduce the impact of COVID-19 on the EU banking sector. From the start, it was made clear that reliable information was still very much a necessity for institutions to provide to the relevant authorities to closely monitor the institutions’ financial situation. But in order to help the institutions out, the EBA advised that the relevant authorities should facilitate the delaying of data submission by a maximum of a month, except for a few very crucial sets of data.

Other RegTech solutions

You can find RegTech solutions for each of the many stages of compliance. For example, Acent, an artificial intelligence (AI) -driven platform, has created a “a visionary regulatory knowledge solution, which automatically delivers up the obligations and rule changes that apply specifically to your business”. This way, all regulatory documents can be analysed for regulatory change management, allowing technology to provide the relevant changes that apply to a particular organisation, without needing to manually read through all changes where many may not be relevant at all.

In order to improve the efficiency of teams who focus on compliance and risk, GRC (Governance, Risk and Compliance) solutions can be implemented which can provide instant auditing, for example, along with storing all obligations and requirements in a central place, for ease of access and clarity.

Point solutions get to the… point. They are often implemented to target a very specific need for a business, i.e. anti-money laundering programs.

RegTech rising

The Financial Conduct Authority (FCA) believes that during this current crisis, RegTech gives both firms and regulators the opportunity to leap further. There is scope for the international development of RegTech using international networks and events, where newly evolving problems can be discussed, and solutions can be provided, from one place to another. In order for regulations to be met and risks to be contained efficiently, both firms and regulators will need to welcome innovation through RegTech, reaping the many benefits of technology in yet another field of work.

Sign up to recieve our newsletters

Don't miss out on our latest content!

Recent posts

Pramod Kumar | 2022-03-04

How Are Investments in Genomics Driving Research Projects?

Science, Healthcare, Business | 4 min read

Dillon Lad | 2021-07-10

4 ways we're destroying the environment without even realising

Environment | 4 min read

Dillon Lad | 2021-04-26

The science behind The Matrix: can we power the world with our own mind and bodies?

Technology, Science, Film | 4 min read

Dillon Lad | 2021-01-29

Breaking up Big Tech with a decentralised internet for the future

Technology | 4 min read