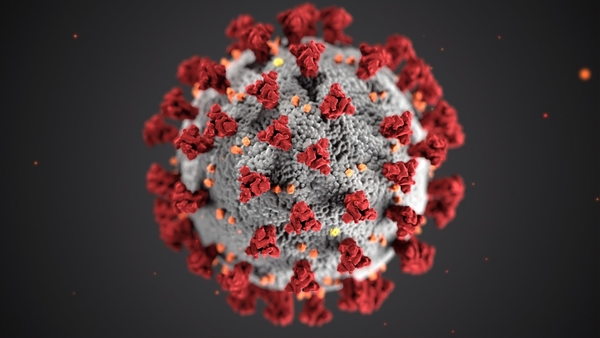

How technology can shape the corporate world of the future: Episode 2 - How has COVID-19 affected FinTech?

It’s no secret that the world, as we know it, has changed. But like with all changes, those who survive and adapt earn the chance to be at the forefront of future change. Here are a few ways in which the world of financial technology (FinTech) is responding to COVID-19, and how these changes could shape the future of the financial industry permanently.

FinTech companies are struggling

Companies that centre around FinTech tend to focus on a particular line of service, or a particular product to provide to its consumers. Now, when the economy is faced with such disruption caused by COVID-19, a company that provides a peer-to-peer (P2P) lending platform may struggle since not many consumers want a personalised loan at this time, or maybe they can’t quite make the repayments on time. LendingClub, the world’s largest P2P lending platform, has had to lay off approximately a third of its total workforce of 1,538 employees in order to comply with a new restructuring plan made in response to COVID-19.

It’s also important to factor in FinTech start-ups. Many will need investments and funding, but the providers of such will be scarce. Unfortunately, it may be the case that such start-ups won’t make it, but those which do, could very much be the new market leaders.

In-person to online

The FinTech industry relies very heavily on conferences, meetings and events; the birthplaces of new relationships, deals and partnerships. Since nearly all of these have been cancelled for now, the switch to needing an online presence has never been more apparent. As a result, such events have been converted to webinars, free-of-charge virtual events and also ticket-based access to networking events apps.

The winners in the long run

It’s tough to focus on positives when so many negatives seem to rise from every direction, but nonetheless, there are some. Having so much of a country’s population working from home, or simply choosing to self-isolate to ‘flatten the curve’, it’s clear that many tasks can be done more efficiently using FinTech, and technology in general. The need for financial services doesn’t halt during a crisis, but in this case, the financial services that will succeed are those that can be provided online. This means that even companies that are hesitant to accept digitisation are going to finally invest in such upgrades, since the consumer audience for digital services is the highest it has ever been.

Tech giants and their banking potential

Companies like Google, Facebook and Amazon are all very capable of providing financial services, themselves. If such companies can already provide some financial solutions to their customers with the purchasing of their products, there’s quite the possibility that in the future they will be able to provide the more traditional types of loans and even mortgages. Having such a big customer base, and plenty of data on all customers, personalised financial products may not be such a stretch for the incoming future.

Looking ahead

In these testing times, there will be winners and losers. The winners in the FinTech industry will be those who adapt. Whether this involves altering business models, collaborating with others, or ensuring the most customer-orientated digital experience, it won’t be easy to survive.

Those who do survive will lead the financial evolution of a post-COVID-19 world: the forefront of change.

Photo credits Denny Müller

Sign up to recieve our newsletters

Don't miss out on our latest content!

Recent posts

Pramod Kumar | 2022-03-04

How Are Investments in Genomics Driving Research Projects?

Science, Healthcare, Business | 4 min read

Dillon Lad | 2021-07-10

4 ways we're destroying the environment without even realising

Environment | 4 min read

Dillon Lad | 2021-04-26

The science behind The Matrix: can we power the world with our own mind and bodies?

Technology, Science, Film | 4 min read

Dillon Lad | 2021-01-29

Breaking up Big Tech with a decentralised internet for the future

Technology | 4 min read